Unlock Forex Trading's Future with Tradextro

Welcome to Tradextro, your premier destination for cutting-edge forex trading solutions. We specialize in providing a comprehensive trading platform that caters to diverse market needs, including forex commodities, shares, indices, and cryptocurrencies.

At Tradextro, we understand the dynamic nature of financial markets and strive to offer tools that enhance your trading experience. Our platform supports various trading methods such as copy trading, MAM (Multi-Account Manager), and PAMM (Percentage Allocation Management Module), ensuring that both novice and experienced traders have the resources they need to succeed.

Our team of well-trained and multilingual professionals is available 24/7 to provide you with unparalleled support and guidance. We are committed to delivering a secure, reliable, and efficient trading environment that empowers you to achieve your financial goals.

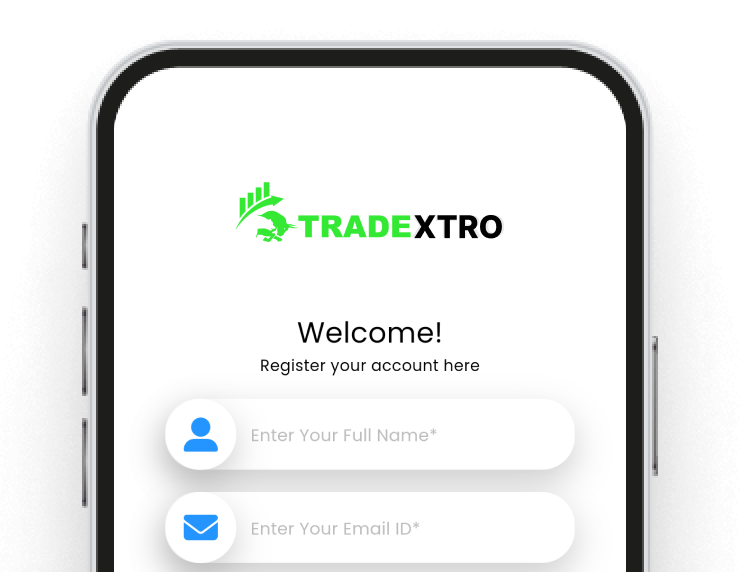

Open an Demo Account

Step-1: Register

Creating account with PayCoin is quick, easy, secure. Simply click to account.

Step-2: Verify

Creating account with PayCoin is quick, easy, secure. Simply click to account.

Step-3: Start Trade

Creating account with PayCoin is quick, easy, secure. Simply click to account.

Our Benefits

Trade Forex With Tradextro

Begin trading with Tradextro on more than 400 instruments, enjoying some of the industry's tightest spreads.

Spreads

Tradextro provides some of the market's most competitive spreads, starting as low as 0.0 pips.

Leverage

Users can enhance their buying power with Leverage up to 1:500, significantly improving the affordability of their trades.

55+ Currency Pairs

There is a broad selection of currency pairs available, categorized into major, minor, and exotic pairs.

Security

Protecting Our Clients Funds

In the fast-paced world of Forex trading, ensuring the security of your investments and personal information is paramount.

Security above all else

Tradextro guarantees the segregation of client funds by keeping them separate from the company’s operational funds. To further minimize risk, client funds are distributed across multiple banks. This proper fund segregation ensures that investors' funds remain secure, even if the company faces insolvency.